: Взаимные фонды Типы рассмотрения вопроса об инвестировании во Взаимные фонды? Тогда крайне важно понять различные типы взаимных фондов и преимущества. Которые они предлагают. Типы взаимных фондов могут быть классифицированы на основе следующих характеристик.

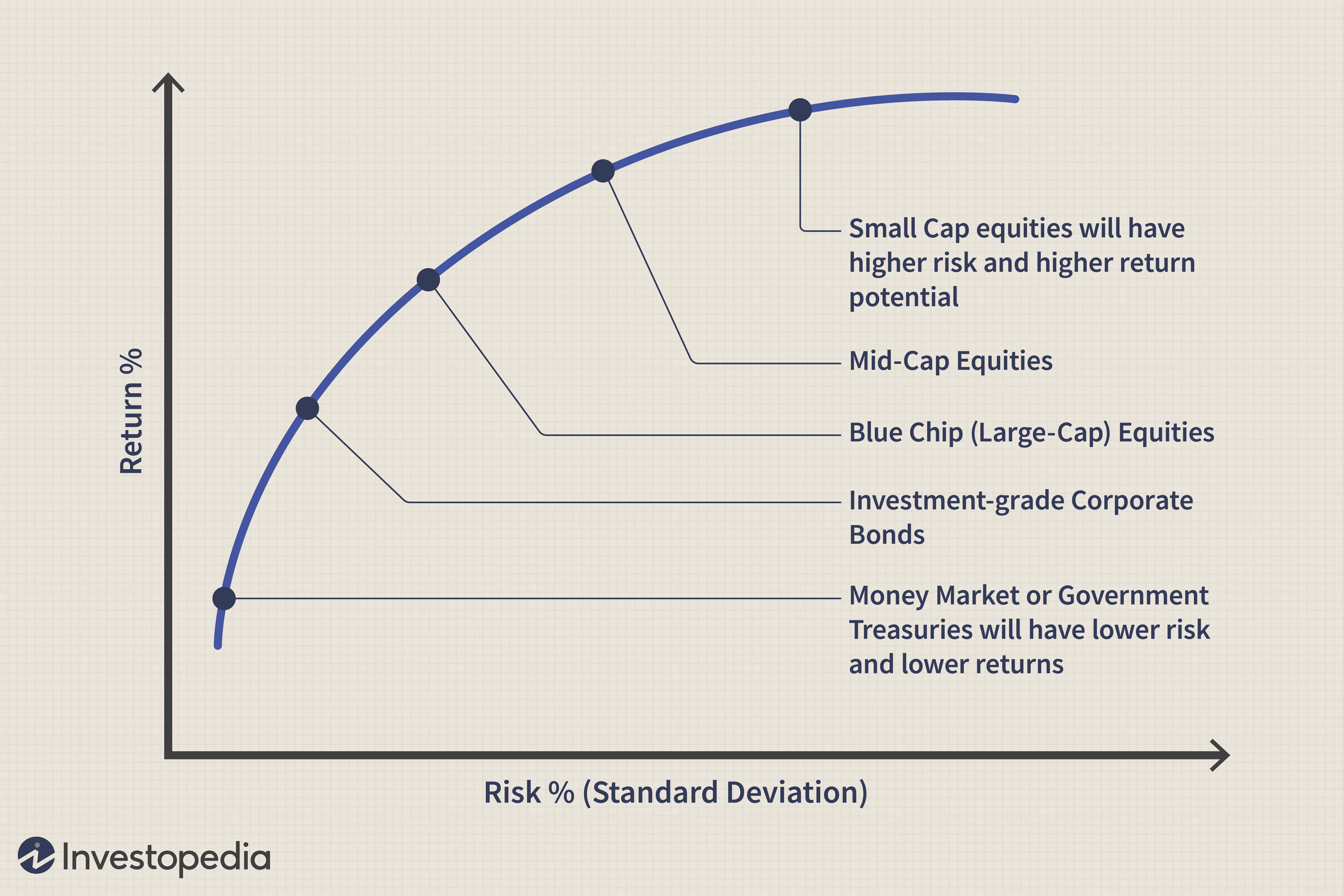

Фонды акций в основном инвестируют в акции и. Следовательно. Также называются фондовыми фондами. Они вкладывают деньги. Собранные различными инвесторами из разных слоев общества. В акции/акции разных компаний. Прибыли и убытки. Связанные с этими фондами. Зависят исключительно от того. Как работают инвестированные акции (повышение или падение цен) на фондовом рынке.

Кроме того, фонды акционерного капитала обладают потенциалом для получения значительной прибыли в течение определенного периода. Следовательно, риск. Связанный с этими фондами, также. Как правило. Сравнительно выше.

Долговые фонды инвестируют в основном в ценные бумаги с фиксированным доходом. Такие как облигации. Ценные бумаги и казначейские векселя. Они инвестируют в различные инструменты с фиксированным доходом. Такие как Планы с фиксированным сроком погашения (FMP). Золотые Фонды. Ликвидные Фонды. Краткосрочные Планы. Долгосрочные Облигации и Планы Ежемесячного дохода. Среди прочего.

Поскольку инвестиции поставляются с фиксированной процентной ставкой и сроком погашения. Это может быть отличным вариантом для пассивных инвесторов. Ищущих регулярный доход (проценты и прирост капитала) с минимальными рисками.

Инвесторы торгуют акциями на фондовом рынке. Точно так же инвесторы также инвестируют на денежном рынке, также известном как рынок капитала или денежный рынок. Правительство управляет им совместно с банками. Финансовыми учреждениями и другими корпорациями. Выпуская ценные бумаги денежного рынка. Такие как облигации. Государственные векселя. Датированные ценные бумаги и депозитные сертификаты. Среди прочего.

Управляющий фондом инвестирует ваши деньги и выплачивает регулярные дивиденды взамен. Выбор в пользу краткосрочного плана (не более 13 месяцев) может значительно снизить риск инвестирования в такие фонды.

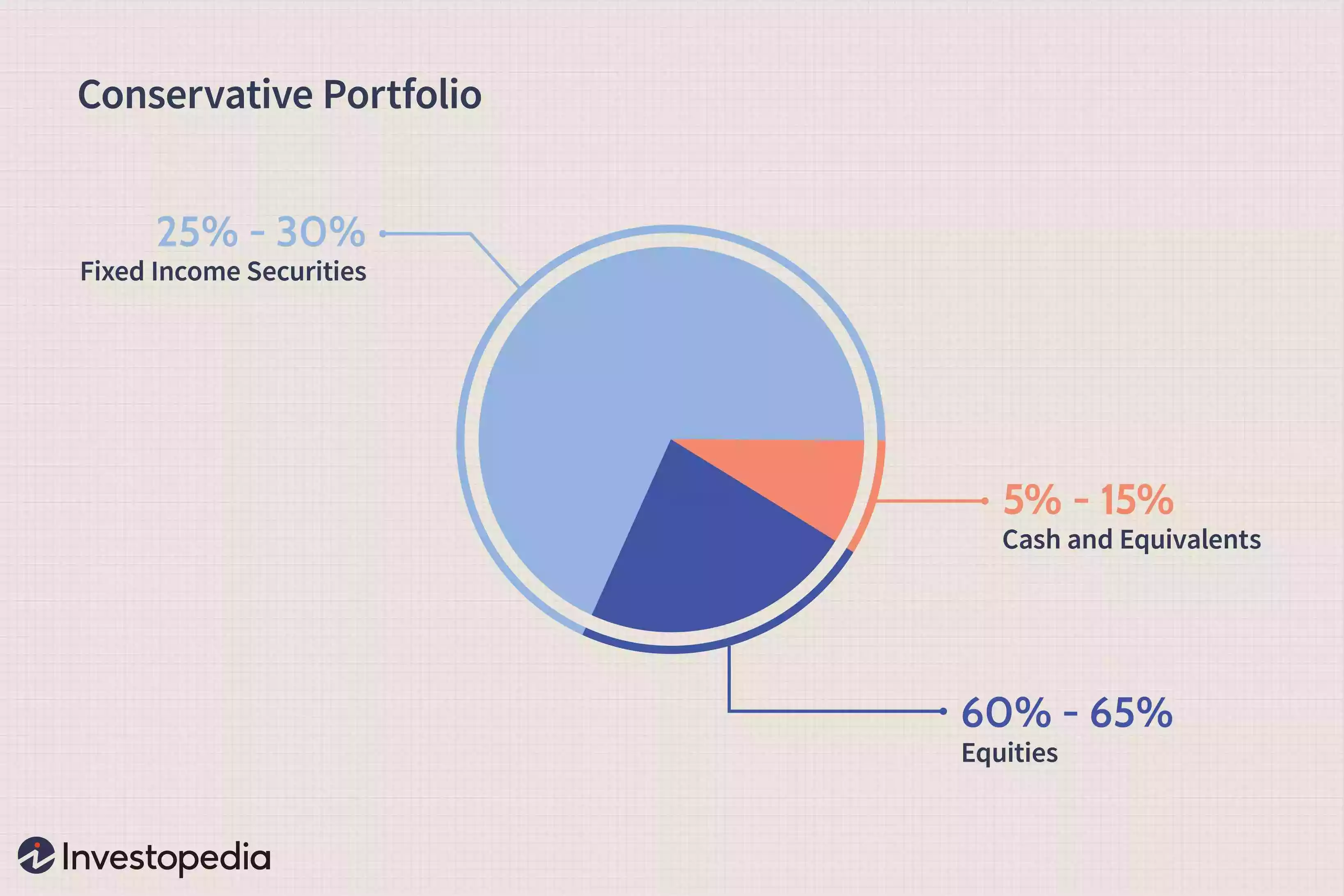

Как следует из названия, гибридные фонды (Сбалансированные фонды) представляют собой оптимальное сочетание облигаций и акций. Тем самым сокращая разрыв между фондами акций и долговыми фондами.

Соотношение может быть как переменным. Так и фиксированным. Короче говоря, он берет лучшее из двух взаимных фондов, распределяя, скажем, 60% активов в акциях. А остальное в облигациях или наоборот. Гибридные фонды подходят для инвесторов. Которые хотят больше рисковать ради выгоды

Взаимные фонды также классифицируются по различным признакам (таким как профиль риска. Класс активов и т.д.). Структурная классификация – фонды открытого типа. Фонды закрытого типа и интервальные фонды-довольно широка. И дифференциация в первую очередь зависит от гибкости покупки и продажи отдельных паев взаимных фондов.

:max_bytes(150000):strip_icc()/AchieveOptimalAssetAllocation-05_2-b386bb863a7f446db2f44d2540c2d1bc.png)

Открытые фонды не имеют каких-либо особых ограничений. Таких как определенный период или количество единиц. Которыми можно торговать. Эти фонды позволяют инвесторам торговать средствами в удобное для них время и выходить. Когда это необходимо. По преобладающей NAV (стоимости чистых активов). Это единственная причина. По которой удельный капитал постоянно меняется с новыми входами и выходами. Открытый фонд также может принять решение прекратить принимать новых инвесторов. Если они не хотят (или не могут управлять значительными средствами).

В закрытых фондах удельный капитал для инвестирования заранее определен. Это означает. Что фондовая компания не может продать больше. Чем заранее согласованное количество единиц. Некоторые фонды также поставляются с Новым периодом предложения фонда (NFO). В котором установлен крайний срок для покупки паев. NFOs поставляется с заранее определенным сроком погашения. А управляющие фондами открыты для любого размера фонда. Следовательно. SEBI обязал предоставить инвесторам возможность либо выкупить опцион. Либо перечислить средства на фондовых биржах для выхода из схем.

Interval funds have traits of both open-ended and closed-ended funds. These funds are open for purchase or redemption only during specific intervals (decided by the fund house) and closed the rest of the time. Also, no transactions will be permitted for at least two years. These funds are suitable for investors looking to save a lump sum amount for a short-term financial goal, say. In 3-12 months.

Growth funds usually allocate a considerable portion in shares and growth sectors. Suitable for investors (mostly Millennials) who have a surplus of idle money to be distributed in riskier plans (albeit with possibly high returns) or are positive about the scheme.

Income funds belong to the family of debt mutual funds that distribute their money in a mix of bonds. Certificate of deposits and securities among others. Helmed by skilled fund managers who keep the portfolio in tandem with the rate fluctuations without compromising on the portfolio’s creditworthiness, income funds have historically earned investors better returns than deposits. They are best suited for risk-averse investors with a 2-3 years perspective.

Like income funds. Liquid funds also belong to the debt fund category as they invest in debt instruments and money market with a tenure of up to 91 days. The maximum sum allowed to invest is Rs 10 lakh. A highlighting feature that differentiates liquid funds from other debt funds is the way the Net Asset Value is calculated. The NAV of liquid funds is calculated for 365 days (including Sundays) while for others. Only business days are considered.

ELSS or Equity Linked Saving Scheme. Over the years. Have climbed up the ranks among all categories of investors. Not only do they offer the benefit of wealth maximisation while allowing you to save on taxes. But they also come with the lowest lock-in period of only three years. Investing predominantly in equity (and related products). They are known to generate non-taxed returns in the range 14-16%. These funds are best-suited for salaried investors with a long-term investment horizon.

Slightly on the riskier side when choosing where to invest in. The Aggressive Growth Fund is designed to make steep monetary gains. Though susceptible to market volatility. One can decide on the fund as per the beta (the tool to gauge the fund’s movement in comparison with the market). Example, if the market shows a beta of 1, an aggressive growth fund will reflect a higher beta, say, 1.10 or above.

If protecting the principal is the priority, Capital Protection Funds serves the purpose while earning relatively smaller returns (12% at best). The fund manager invests a portion of the money in bonds or Certificates of Deposits and the rest towards equities. Though the probability of incurring any loss is quite low. It is advised to stay invested for at least three years (closed-ended) to safeguard your money. And also the returns are taxable.

Many investors choose to invest towards the of the FY ends to take advantage of triple indexation. Thereby bringing down tax burden. If uncomfortable with the debt market trends and related risks, Fixed Maturity Plans (FMP) – which invest in bonds, securities. Money market etc. – present a great opportunity. As a close-ended plan. FMP functions on a fixed maturity period. Which could range from one month to five years (like FDs). The fund manager ensures that the money is allocated to an investment with the same tenure. To reap accrual interest at the time of FMP maturity.

Putting away a portion of your income in a chosen pension fund to accrue over a long period to secure you and your family’s financial future after retiring from regular employment can take care of most contingencies (like a medical emergency or children’s wedding). Relying solely on savings to get through your golden years is not recommended as savings (no matter how big) get used up. EPF is an example. But there are many lucrative schemes offered by banks. Insurance firms etc.

Liquid funds and ultra-short-term funds (one month to one year) are known for its low risk. And understandably their returns are also low (6% at best). Investors choose this to fulfil their short-term financial goals and to keep their money safe through these funds.

In the event of rupee depreciation or unexpected national crisis. Investors are unsure about investing in riskier funds. In such cases. Fund managers recommend putting money in either one or a combination of liquid. Ultra short-term or arbitrage funds. Returns could be 6-8%. But the investors are free to switch when valuations become more stable.

Here, the risk factor is of medium level as the fund manager invests a portion in debt and the rest in equity funds. The NAV is not that volatile. And the average returns could be 9-12%.

Suitable for investors with no risk aversion and aiming for huge returns in the form of interest and dividends. High-risk mutual funds need active fund management. Regular performance reviews are mandatory as they are susceptible to market volatility. You can expect 15% returns. Though most high-risk funds generally provide up to 20% returns.

Sector funds invest solely in one specific sector. Theme-based mutual funds. As these funds invest only in specific sectors with only a few stocks. The risk factor is on the higher side. Investors are advised to keep track of the various sector-related trends. Sector funds also deliver great returns. Some areas of banking. IT and pharma have witnessed huge and consistent growth in the recent past and are predicted to be promising in future as well.

Suited best for passive investors, index funds put money in an index. A fund manager does not manage it. An index fund identifies stocks and their corresponding ratio in the market index and put the money in similar proportion in similar stocks. Even if they cannot outdo the market (which is the reason why they are not popular in India). They play it safe by mimicking the index performance.

A diversified mutual fund investment portfolio offers a slew of benefits. And ‘Funds of Funds’ also known as multi-manager mutual funds are made to exploit this to the tilt – by putting their money in diverse fund categories. In short, buying one fund that invests in many funds rather than investing in several achieves diversification while keeping the cost down at the same time.

To invest in developing markets is considered a risky bet. And it has undergone negative returns too. India, in itself. Is a dynamic and emerging market where investors earn high returns from the domestic stock market. Like all markets. They are also prone to market fluctuations. Also, from a longer-term perspective. Emerging economies are expected to contribute to the majority of global growth in the following decades.

Favoured by investors looking to spread their investment to other countries. Foreign mutual funds can get investors good returns even when the Indian Stock Markets perform well. An investor can employ a hybrid approach (say, 60% in domestic equities and the rest in overseas funds) or a feeder approach (getting local funds to place them in foreign stocks) or a theme-based allocation (e.g.. Gold mining).

Aside from the same lexical meaning. Global funds are quite different from International Funds. While a global fund chiefly invests in markets worldwide. It also includes investment in your home country. The International Funds concentrate solely on foreign markets. Diverse and universal in approach. Global funds can be quite risky to owing to different policies. Market and currency variations. Though it does work as a break against inflation and long-term returns have been historically high.

Despite the real estate boom in India. Many investors are still hesitant to invest in such projects due to its multiple risks. Real estate fund can be a perfect alternative as the investor will be an indirect participant by putting their money in established real estate companies/trusts rather than projects. A long-term investment negates risks and legal hassles when it comes to purchasing a property as well as provide liquidity to some extent.

These funds are ideal for investors with sufficient risk-appetite and looking to diversify their portfolio. Commodity-focused stock funds give a chance to dabble in multiple and diverse trades. Returns, however. May not be periodic and are either based on the performance of the stock company or the commodity itself. Gold is the only commodity in which mutual funds can invest directly in India. The rest purchase fund units or shares from commodity businesses.

For investors seeking protection from unfavourable market tendencies while sustaining good returns. Market-neutral funds meet the purpose (like a hedge fund). With better risk-adaptability. These funds give high returns where even small investors can outstrip the market without stretching the portfolio limits.

While a regular index fund moves in tandem with the benchmark index. The returns of an inverse index fund shift in the opposite direction. It is nothing but selling your shares when the stock goes down. Only to repurchase them at an even lesser cost (to hold until the price goes up again).

Combining debt. Equity and even gold in an optimum ratio. This is a greatly flexible fund. Based on a pre-set formula or fund manager’s inferences based on the current market trends, asset allocation funds can regulate the equity-debt distribution. It is almost like hybrid funds but requires great expertise in choosing and allocation of the bonds and stocks from the fund manager.

Yes, you can also gift a mutual fund or a SIP to your loved ones to secure their financial future.

It belongs to the index funds family and is bought and sold on exchanges. Exchange-traded Funds have unlocked a new world of investment prospects. Enabling investors to gain extensive exposure to stock markets abroad as well as specialised sectors. An ETF is like a mutual fund that can be traded in real-time at a price that may rise or fall many times in a day.

As a tax-paying citizen. The Section-80c of the Indian Tax Act allows you some breather – a deduction of up to 150,000 from your total annual income.

You may classify mutual funds into open-end and closed-end funds. An open-end fund does not have a fixed maturity period. You may redeem the units at any time. Closed-end funds have a fixed maturity period.

You may invest in these funds during the initial period called the New Fund Offer. You can redeem your investment on the maturity date. However, closed-end funds are listed on the stock exchange and you may redeem units before the maturity date.

Mutual funds may invest in equity and equity-related instruments. Debt or a mix of both. You can broadly classify mutual funds into equity funds. Debt funds and hybrid funds.

Equity funds: Equity funds invest at least 65% of the total assets in equity and equity-related instruments. It may invest the remaining corpus in debt and money market instruments.

Debt funds:Debt funds invest the bulk of the corpus in fixed income instruments such as bonds. Government securities and money market instruments such as treasury bills. Commercial paper and certificates of deposit.

Hybrid funds: Hybrid funds put money in more than one asset class. It may be a combination of equity. Debt and even a small proportion in gold. Hybrid funds are of different types such as aggressive hybrid funds. Conservative hybrid funds. Dynamic asset allocation or balanced advantage fund. Equity savings fund. Multi-asset allocation fund and balanced hybrid funds.

SEBI had announced the re-categorisation of mutual fund schemes on October 6, 2017. It was done to bring uniformity as mutual fund houses had launched several mutual fund schemes. You may find investing in mutual funds quite easy after this move. As investors put money in mutual fund schemes that match their investment objectives and risk tolerance. Investors used to struggle to select the right mutual fund as AMCs had launched a plethora of similar mutual fund schemes.

SEBI had classified mutual funds into the following categories: