Тинькофф Банк объявляет о запуске Tinkoff Investments Premium. Предоставляющей доступ к более чем 10 000 глобальных ценных бумаг (самый обширный каталог на российском рынке) и предоставляющей услуги персонального менеджера непосредственно в мобильном приложении.

Продуктовая линейка Tinkoff Investments Premium была расширена и предлагает доступ к более чем 10 000 ценным бумагам эмитентов из 30 стран (сотни иностранных ETF. Еврооблигации. В том числе с высокодоходных развивающихся рынков. Иностранные акции и облигации и др.).

Одной из ключевых особенностей сервиса является отсутствие минимального порога входа. Связанного с балансом счета. Таким образом. Тинькофф Банк становится одним из первых на российском рынке. Предлагающим премиальные услуги как можно большему числу инвесторов.

Чтобы начать пользоваться Tinkoff Investments Premium. Вам необходимо быть клиентом брокерской платформы Tinkoff Investments и получить персональное приглашение от банка. Либо подать заявку на доступ к премиум-сервису через Tinkoff.ru.

Ежемесячная подписка (3000 рублей) – это все. Что необходимо для доступа к базовому каталогу ценных бумаг в рамках премиального сервиса Тинькофф. Плата за первый месяц не взимается. Полный каталог доступен только квалифицированным инвесторам. После получения этого статуса через чат мобильного приложения клиенту Tinkoff Investments Premium предоставляются неограниченные инвестиционные возможности.

Например, можно инвестировать в облигации таких эмитентов. Как Alibaba. Ford и IBM. Фондовые инвесторы получат доступ к таким компаниям, как Sony. Samsung, Siemens. Airbus, Adidas. Domino’s Pizza. Volkswagen и Unilever. Можно даже вложить свои деньги в роботов-пылесосов. Команду разработчиков GTA V или Tinder.

Операции с ценными бумагами из базового каталога Tinkoff Investments облагаются комиссией в размере 0,03%. А торговля акциями. Паевыми инвестиционными фондами. ETF или депозитарными расписками. Включенными в расширенный список. – комиссией в размере 0,3%. Комиссия в размере 1-2% применяется к сделкам с облигациями. Еврооблигациями. Структурированными нотами или другими финансовыми инструментами из этого списка.

“Экосистема Тинькофф продолжает наращивать свои премиальные возможности. В апреле мы запустили дебетовые и кредитные карты Tinkoff Black Edition и Tinkoff ALL Airlines Black Edition для состоятельных клиентов. И сегодня мы рады представить Tinkoff Investments Premium. Совершенно новый продукт для инвесторов. Премиальный сервис теперь доступен гораздо более широкой аудитории. Причем все коммуникации осуществляются через мобильное приложение. Премиальным клиентам больше не нужно тратить время на телефонные звонки или встречи с консультантами. Так как даже самые сложные инвестиционные продукты – такие как банкнота или портфель из 20 ценных бумаг – можно приобрести одним щелчком мыши через мобильное приложение. Мы позитивно оцениваем перспективы нашего премиального инвестиционного инструмента и ожидаем. Что в 2019 году он привлечет до 5% клиентов Tinkoff Investments”. – отметил вице-президент по развитию новых продуктов Тинькофф Банка Александр Емешев.

In the upcoming paragraphs. We will detail an easy way to start investing in financial instruments. For investors with little capital [Little capital = 100 Dollars].

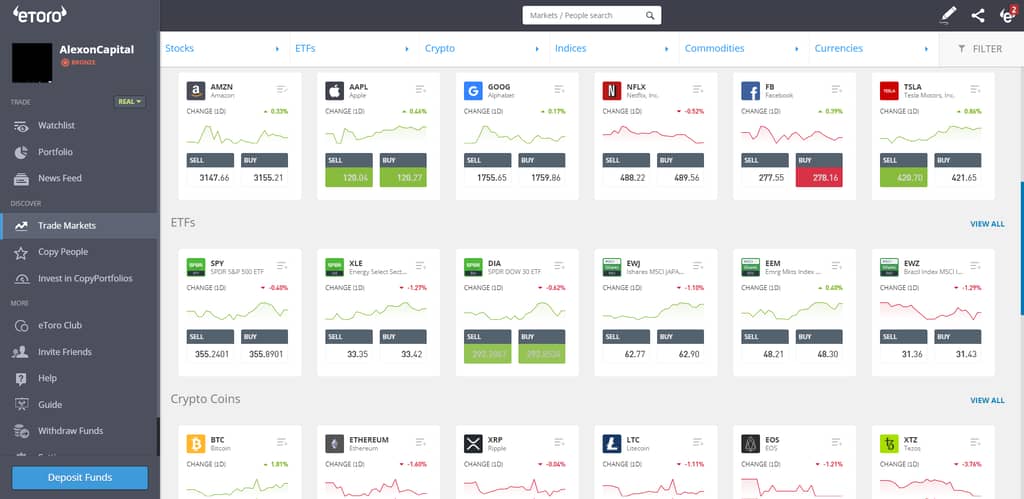

We start this article with a list of Brokers available to clients living in Russia [For those readers who are in a hurry!].

Many Russians ask us if it is possible to buy US stocks being a non-US citizen. Stocks and bonds are indeed regulated by US law, yet. You do not have to be a US citizen to trade in the US stock market. In other words, you may buy US shares being a Russian citizen. No specific laws prohibit non-US citizens from investing in the different US stock markets like NYSE (New York Stock Exchange) or Nasdaq.

Many investment firms cater to international clients.

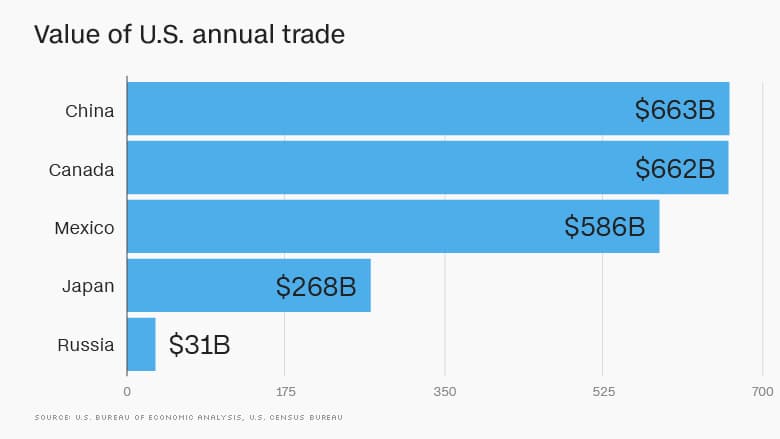

Based on the mythical Wall Street. The New York Stock Exchange (NYSE) is the most extensive in the world by market capitalization where shares and bonds of the titanic North American corporations are traded. Suppose a saver from Russia invests in stocks or bonds listed on the New York Stock Exchange. In that case. He is investing in the historically strong US Dollar and diversifying his investments with the most traded financial instruments worldwide.

Shares of giant American Corporations are the most sought after financial assets by the general public. Below we list [Some of] the most popular stocks of these two Stock Markets. Starting from the ones that trade on NYSE:

Berkshire Hathaway: An investment corporation owned by the legendary investor Warren Buffet.

Alibaba Group: China’s e-commerce giant. Owned by Jack Ma.

Visa: Largest provider of credit cards in the world.

Johnson & Johnson: An industrial colossus that produces articles of mass consumption.

J.P. Morgan Chase: Diversified Financial Group.

Exxon Mobil: World’s largest oil and gas producer.

Walmart: Number 1 supermarket chain worldwide.

Procter & Gamble: Another mass consumption industrial giant.

Mastercard: Provider of credit cards worldwide.

Walt Disney: The well-known entertainment and content company is also listed on the NYSE.

Among the Nasdaq’s most popular stocks are the tech giants:

Apple: The company that revolutionized the mobile business by creating the iPhone. Needs no further introduction.

Facebook: Another one that doesn’t need an introduction: The largest social network worldwide.

Amazon: The most popular eCommerce platform in the United States and the world.

Netflix: Application of series and movies with the largest number of subscribers worldwide.

Google (Alphabet): The Well-known tech giant. We only need to mention that Google’s shares are called

Tesla: Elon Musk’s vision.

These are unfinished lists of the most well-renowned shares; there’s a significant number of internationally recognized companies and brands available to invest. A rounded way of investing is to invest in the S&P500 index. Which groups the top 500 companies that are part of both the New York Stock Exchange and the Nasdaq.

Standard & Poor’s 500 Index, also known as S&P500, is one of the most extensively respected stock market indices in the United States (The other one is the Dow Jones). The S&P 500 is considered the most representative index of US’ real economy.

The index is based on the market capitalization of 500 large companies that issued shares on either the NYSE or the NASDAQ markets. The S&P500 represents approximately 80% of the entire capitalization of the United States Stock Market. The S&P500 index components and their weighting are determined by the S&P Dow Jones Indices rating agency. It differs from other indexes in the United States’ financial markets. Such as the Dow Jones Industrial Average or the Nasdaq Composite index. In the diversity of the items that make it up and its weighting methodology. It is by far the most invested stock index globally. Many people consider it the trend marker of the North American economy; that is. If the S&P500 goes up. The economy is doing well.

Investing in a financial instrument that replicates the S&P500 Index is (the best?) an excellent way to invest in a good portion of the North American economy through the shares of its corporate giants.

Unlike most general public thinks. The answer to this question is that many stockbrokers do not have a minimum deposit (or a tiny amount of cash); which means no minimum amount. Also, to gain more clients. Many brokers do not charge a commission to acquire American companies’ shares.

Opening an investment account with an Online Broker is a process that is completed online and requires:

First, choose the broker that best fits your investment goals.

Upload an ID and a proof of address (electricity. Water bills, etc.). Through the Broker’s App or via email.

Make sure to choose the right base currency of the account. With some brokers. Changing it once you open the account can be painful. Trading Accounts may be based in US Dollars (USD). Euros (EUR). Pound Sterling (GBP). Swiss Franc (CHF). Australian Dollar (AUD) as the base currency. Practically all of them offer the option in US Dollars or Euros.

Once the account has been approved by the Broker. It’s time to deposit cash. The depositing and withdrawing money methods are usually Credit Cards. Bank Transfers or eWallets (PayPal. PaySafe, Skrill. SafetyPay, Neteller. Among many others). The available options to deposit funds will depend on each Broker. A vital fact to mention is that all of the Brokers presented above allow you to use a simulator on their platform, that is. They allow testing their Demo account. Which is totally Free. In other words. You can open a Demo account. Try the platform. And then decide whether to deposit money or not.

Online Brokers allow investing in the New York Stock Exchange straightforwardly through optimized apps that grant easy and fast access to the US financial markets. In fact, most platforms resemble a social network or any other phone app: They are designed so that the investor can learn and start trading very quickly. Without the need for much prior knowledge. Literally, to buy shares of. For example, Apple. Or to invest in a financial instrument that replicates the S&P500 index. You have to:

open a trading account as explained before,

deposit money,

Search for

press the

And, done, you are officially investing in American related financial assets. If you wish to move forward. Check out the 4 options that we have presented initially, which are. In our opinion. The best ones to deal with in Russia.

While helping to write the US Constitution. Benjamin Franklin said: Our new Constitution is now established. Everything seems to promise it will be durable; but. In this world. Nothing is certain except death and taxes.

However, things aren’t that bad. Since you would be classified as a non-resident alien (you are a foreigner. And you don’t live in the US) by the IRS (the US tax watchdog). Sowouldn’t be subject to Capital Gains Tax. But only to the Dividend Tax of 30%.

And does that work? Your broker would withhold the amount. Whenever the company you invested in pays dividends to your trading account. For example. If you invest in 100 Apple shares and pay dividends for $0,20 per share. You would get $20 minus $6, that is. A net amount of $14.

The US Stock Market is by far the largest in the World. When investing there. You are technically investing with the US Dollar. The most sought after currency. If you are going to place your savings anywhere. The bottom line is the #1 Economic Superpower perhaps it’s not the wrong place.